My Medical Benefits

Medical

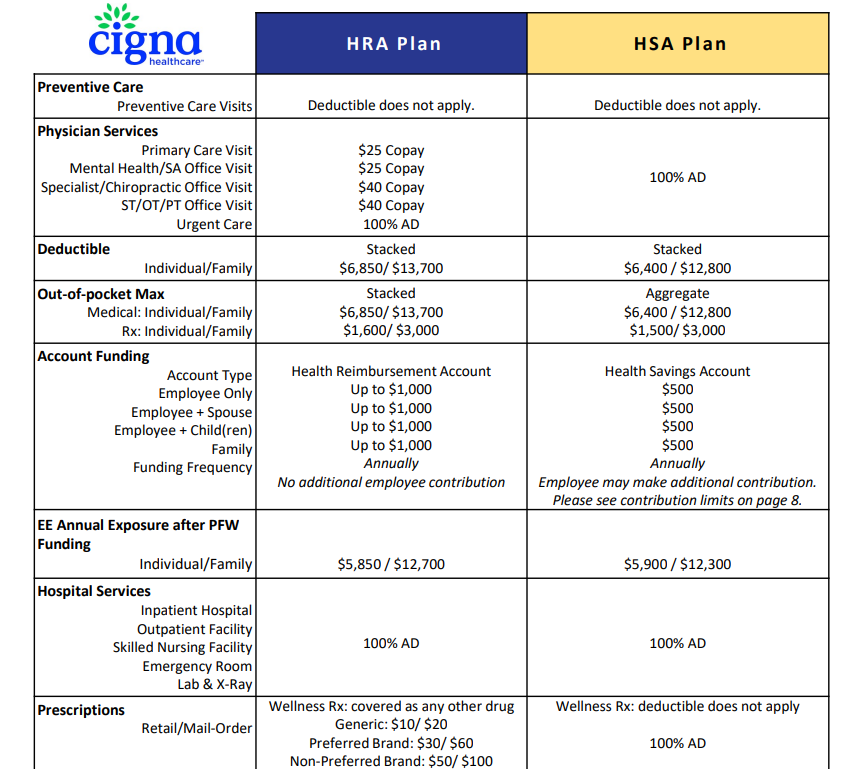

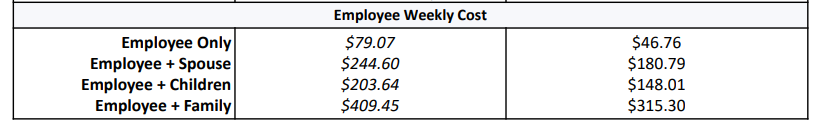

Pet Food Warehouse offers employees 2 plan options – an HRA Plan and HSA Plan. The plans are administered by Cigna. PFW will pay a portion of your premium based on your coverage tier (single, double, or family).

PFW Will Contribute $400 Per Person Per Month to each plan.

Plan Documents

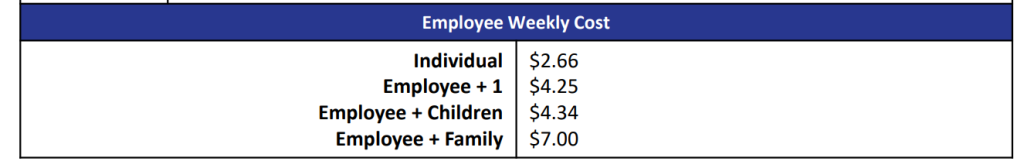

Employee Contributions

Eligibility

Contact Us

1-866-494-2111

www.mycigna.com

Pharmacy Information

MyCigna.com Resources

Discount Programs for Weight Loss

Forms and Plan Information

My HRA Benefits

Health Reimbursement Account

A Health Reimbursement Arrangement (HRA) is an employer-funded account that is designed to reimburse employees for qualified medical expenses that are paid out-of-pocket. HRAs are often designed to operate with a high deductible health plan (HDHP). PFW HRA funds will be prorated for date of hire.

Eligibility

If you enroll in the HRA Medical Plan, PFW provides employees with an HRA through Cigna to help with out-of-pocket expenses, such as copayments and deductibles. PFW will fund all eligible employee’s accounts with $1,000 in 2025. The HRA reimburses you for the first $1,000 of out-of-pocket expenses.

Contributions

Your employer funds the account, so it costs you nothing out-of-pocket. Unused dollars remain with the employer and cannot be carried over year to year.

Qualified Medical Expenses

You can use your HRA funding for all IRS eligible qualified health expenses including medical, prescription, dental and vision.

Who is Eligible?

My HSA Benefits

Health Savings Account

The HSA Medical Plan is considered a Qualified High Deductible Health Plan. In 2025, PFW will fund each employee’s Health Savings Account (HSA) in the amount of $500. You can open an HSA at your local bank. PFW will deposit funds into your HSA on a per pay period basis and will be prorated for date of hire.

Qualified Expenses

Money can be used to pay for medical, dental and vision services on a pre-tax basis. Only funds in the account are available for use. This is a bank account that belongs to the employee and all funds in the account remain with the employee.

Maximum HSA Contributions

The maximum amount you can contribute in 2025 is $4,300 on an individual plan or $8,550 on a +1 or family plan. If you are over age 55 you can put in an additional $1,000. You may contribute additional funds to the HSA each pay period up to the maximum amount. After PFW contributes $500, the maximum amount employees can contribute in 2024 is $3,800 (Individual) or $73.07 per pay period and $8,050 (Couple or Family) or $154.80 per pay period.

Who is Eligible?

HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Health Savings Account.

Did you know you could use your HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

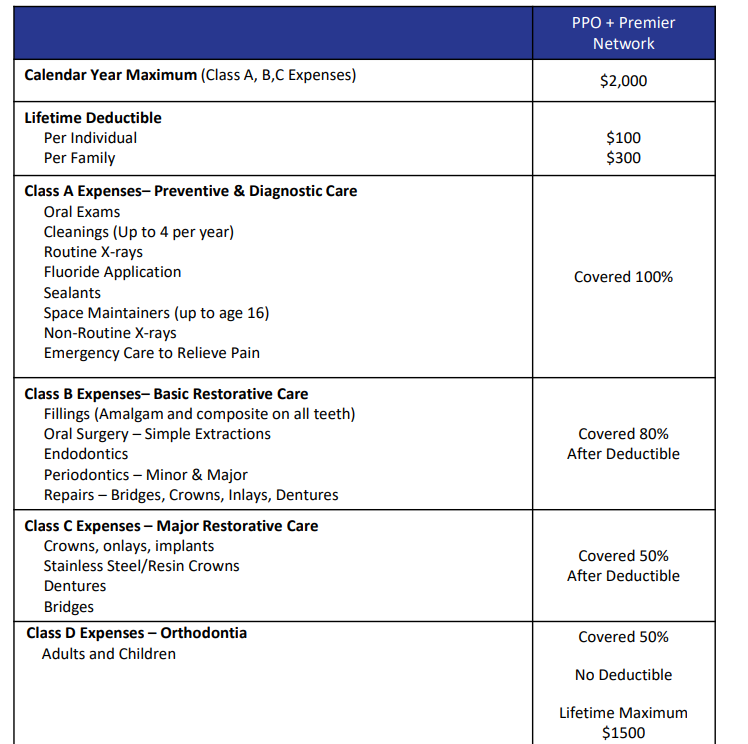

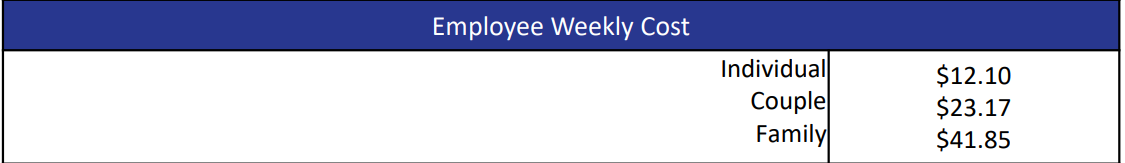

My Dental Benefits

Forms and Plan Documents

My Vision Benefits

Contributions

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 60 days of full-time active employment.

Forms and Plan Documents

My Voluntary Life & AD&D Benefits

Voluntary Life/AD&D Insurance

- Employees and Spouses: $10,000 to $500,000 in increments of $10,000.

- Employee guaranteed issue amount: $100,000

- Spouse guaranteed issue amount: $30,000

- Dependent Children: 14 days to 6 months – $1,000 flat benefit amount

- Dependent Children: 6 months to 25 years – Choice of $2,500, $5,000, $7,500, or $10,000 (one benefit amount and one rate for all eligible children in family)

Voluntary Dependent Life/AD&D

This benefit, offered through Reliance Standard, is Voluntary and 100% employee paid.

-

- Spouse: Choice of coverage from $10,000 – $500,000 in increments of $10,000

- Required to give satisfactory evidence of insurability for supplemental life amounts above $30,000 upon initial eligibility; after initial eligibility all benefit amounts are subject to evidence of insurability

- Child: Age 14 days to 6 months – $1,000 flat benefit amount. Age 6 months to 25 years – choice of coverage in $2,500 increments up to $10,000

- Accidental Death and Dismemberment benefits mirror the Life Insurance benefits but must be elected separately.

Eligibility

PFW offer Voluntary Life Insurance/AD&D to all full time, benefit eligible employees. All employees are eligible to enroll in this benefit the 1st of the month following 90 days of employment. Employees pay 100% of this benefit and rates are based on age bands.

My Short Term Disability Benefits

Short Term Disability

- Begins on the 1st day of a Disability due to Accidental Injury; and 8th consecutive day of Disability due to an illness.

- Pays 66 2/3% of an employee’s weekly earnings up to $1,750 per week and for a maximum of 26 weeks.

Eligibility

PFW provides short term disability insurance and contributes to the entire cost for all full time, benefit eligible employees. All employees are eligible for this benefit the 1st of the month following 90 days of employment.

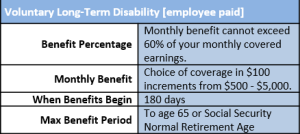

My Voluntary Long Term Disability Benefits

Long Term Disability

Long Term Disability insurance protects an employee from loss of monthly income in the event that he or she is unable to work due to illness, injury, or accident for a long period of time.

Eligibility

PFW offer Voluntary Long Term Disability to all full time, benefit eligible employees. All employees are eligible to enroll in this benefit the 1st of the month following 90 days of employment. Employees pay 100% of this benefit and rates are based on age bands.

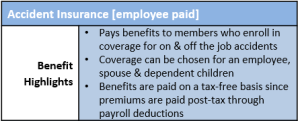

My Voluntary Accident Insurance Benefits

Voluntary Accident Insurance

No one likes to think about the possibility of an accident, but the likelihood — as well as the havoc it can cause for families — is very real. Whether it’s an automobile accident, sports injury or the inevitable slip-and-fall, an accident can bring about not only lifestyle challenges but tangible economic ones as well.

Eligibility

All employees are eligible for Voluntary Accident coverage the first of the month following 90 days of employment. Employees pay 100% for these benefits.

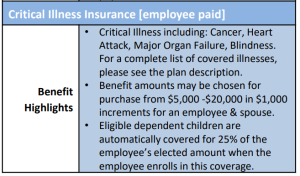

My Voluntary Critical Illness Benefits

Voluntary Critical Illness

Reliance Standard’s Voluntary Group Critical Illness insurance provides a fixed, lump-sum benefit when critical illness strikes. This includes heart attack, stroke, paralysis and more.

Eligibility

All employees are eligible for Voluntary Critical Illness coverage the first of the month following 90 days of employment. Employees pay 100% for these benefits.

My Pet Insurance Benefits

Health Coverage For Your Furriest Family Members

- Coverage for Cats and Dogs of All Ages and Breeds

- No Initial Exam/Past Vet Notes Required

- Accident Coverage Starts at Midnight

- Customizable and Out-of-Pocket Max

- Annual Max Payouts as Opposed to Per Incident

- Choose Your Reimbursement Percentage

- Multiple Value-Added Benefits Included

- Routine Care Option Available with Customized Plans

- Available in all 50 States!

My Retirement Benefits

Pet Food Warehouse, Ltd. offers a 401(k) plan to employees through T. Rowe Price. T. Rowe Price offers a wide selection of investment options and excellent online technology to help you better plan for retirement. Basic plan details are listed below and outlined in more detail in the Summary Plan Description. If you have questions about the plan, you can send an email to HelpRetire@therichardsgrp.com to receive assistance from TRG Retirement Plan Consultants. You can also call: T. Rowe Price directly at (800) 354-2351 or access your account online at www.rps.troweprice.com/.

You may contribute $23,500 for calendar year 2025. If you are age 50 or older, you can make an additional catch-up contribution of $7,500 for a combined $31,000. Beginning 1/1/2025, a higher total elective deferral catch-up limit of $11,250 is allowed for participants who are ages 60, 61, 62, or 63. So individuals in these age bands can defer a combined annual maximum of $34,750. Annual limitations are set by the IRS and are subject to change.

Contact Information

Investment Advisor

TRG Retirement Plan Consultants

(802) 254-6016

Important Documents

My Student Loan Assistance Benefits

Student Loan Assistance

The Pet Food Warehouse tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being. Consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will:

- Provide one-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- Offer a competitive interest rate reduction when you refinance your loans.

- Offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Us

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Forms and Plan Documents

My Employee Discounts

Volunteer for CTO Time

If a full-time employee chooses to do so, PFW will give each eligible employee up to an additional 8 hours of CTO time per calendar year for exchange of time volunteering for an organization that supports, promotes or in some way helps animals. Prior approval must be obtained by the General Manager. There is no waiting period to take advantage of this benefit.

Employee Purchase Program

Employees will be entered in the POS as a customer, which gives the employee discounts on products purchased in our stores.

Pet Wash Program

Employees may use the Pet Wash Monday through Friday at no cost for their pet(s) only, based on availability.

Employee Feeding Program

As a distributor for many of our food lines, some of the manufacturers allow us a significant discount off our cost of their food for employee feeding and PFW pays the balance – which allows the employee to feed their dog or cat for free.

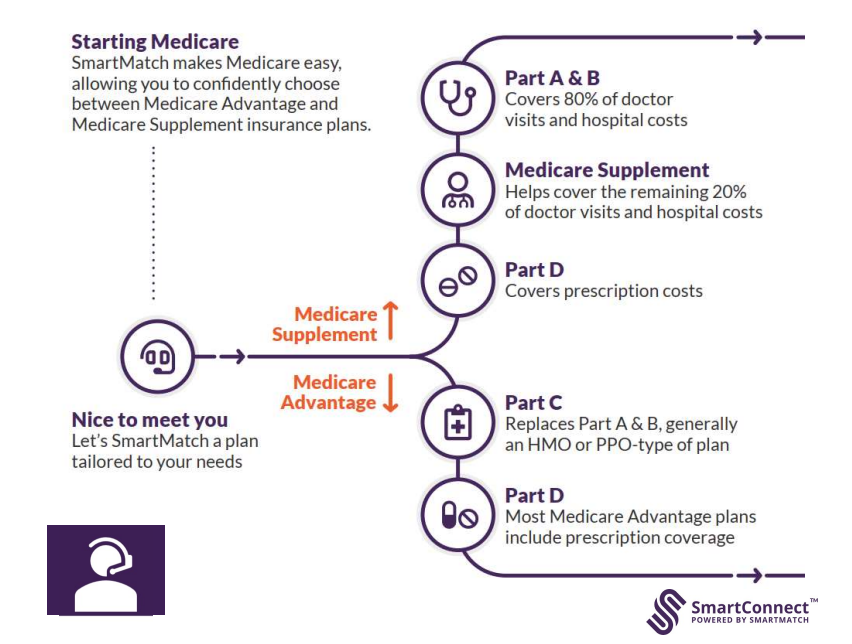

SmartConnect – Medicare Resource

Medicare is very complex, and it is important that you have an advocate who can provide you the proper Medicare education and guidance.

There are different paths you can choose in Medicare plans, and it can be very time consuming and difficult to filter through these options yourself. It is important that you find the appropriate plan in your area that best fits your medical needs and is within your financial budget.

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

SmartMatch Insurance

1-833-502-2747 | TTY: 711

Additional Information