2023

Benefits at a Glance

Medical

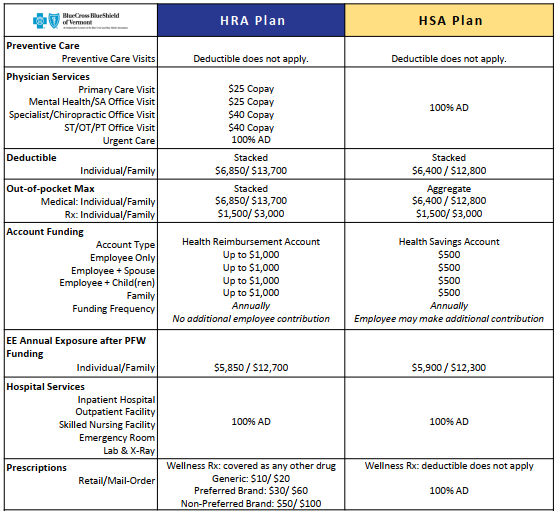

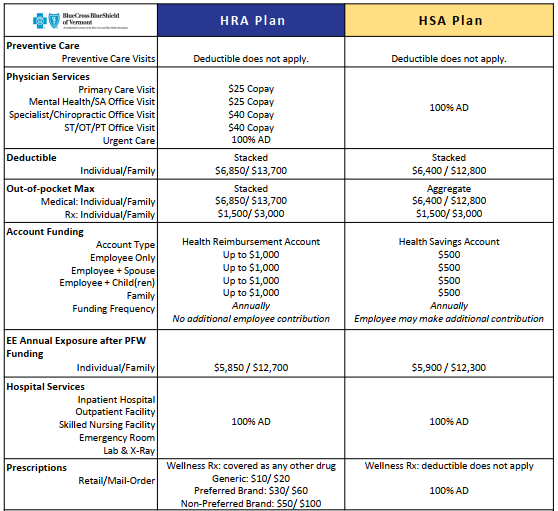

Pet Food Warehouse offers employees 2 plan options – an HRA Plan and and HSA Plan. The plans are administered by Blue Cross Blue Shield of Vermont. PFW will pay a portion of your premium based on your coverage tier (single, double, or family).

PFW Will Contribute $390 Per Person Per Month to each plan.

Employee Contributions

Employee Weekly Cost

| Employee Only Employee + Spouse Employee + Children Employee + Family |

$45.20 $175.78 $143.47 $305.82 |

$37.79 $160.97 $130.84 $284.57 |

Eligibility

Contact Us

Blue Cross Blue Shield of Vermont

#800-247-2583

www.bcbsvt.com

Forms and Plan Documents

Additional Information

Who is Eligible?

Health Reimbursement Account

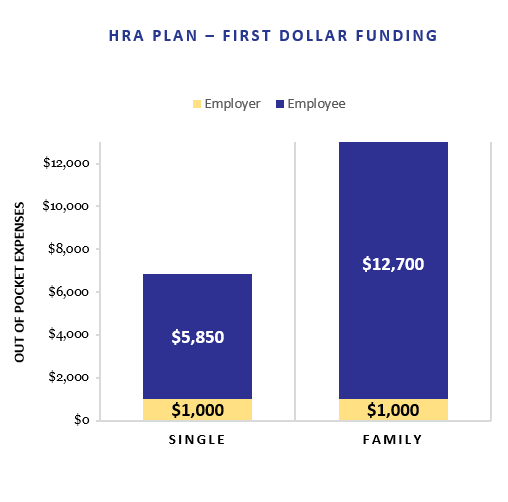

A Health Reimbursement Arrangement (HRA) is an employer-funded account that is designed to reimburse employees for qualified medical expenses that are paid out-of-pocket. HRAs are often designed to operate with a high deductible health plan (HDHP). PFW HRA funds will be prorated for the date of hire.

Eligibility

If you enroll in the HRA Medical Plan, PFW provides employees with an HRA through Health Equity to help with out-of-pocket expenses, such as copayments and deductibles. PFW will fund all eligible employee accounts with $1,000 in 2023. The HRA reimburses you for the first $1,000 of out-of-pocket expenses.

Contributions

Your employer funds the account, so it costs you nothing out of-pocket. Unused dollars remain with the employer and cannot be carried over from year to year.

Qualified Medical Expenses

You can use your HRA funding for all IRS-eligible qualified health expenses, including medical and prescription, up to $250 for dental, and up to $250 for vision.

Health Savings Account

The HSA Medical Plan is considered a Qualified High Deductible

Health Plan. In 2023, PFW will fund each employee’s Health

Savings Account (HSA) in the amount of $500. You can open an

HSA at your local bank. PFW will deposit funds into your HSA on a

per pay period basis and will be prorated for date of hire.

Qualified Expenses

Money can be used to pay for medical, dental and vision services

on a pre-tax basis. Only funds in the account are available for use.

This is a bank account that belongs to the employee and all funds

in the account remain with the employee.

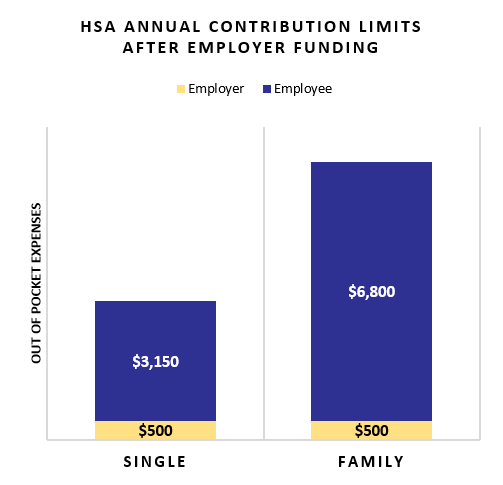

Maximum HSA Contributions

The maximum amount you can contribute in 2023 is $3,850 on an

individual plan or $7,750 on a +1 or family plan. If you are over

age 55 you can put in an additional $1,000. You may contribute

additional funds to the HSA each pay period up to the maximum

amount. After PFW contributes $500, the maximum amount

employees can contribute in 2023 is $3,150 (Individual) or $60.58

per pay period and $6,800 (Couple or Family) or $130.77 per pay

period.

Eligibility:

Employees who work at least thirty (30) hours per week are eligible for medical coverage on the first of the month following 60 days of full-time active employment.

Employee Contributions

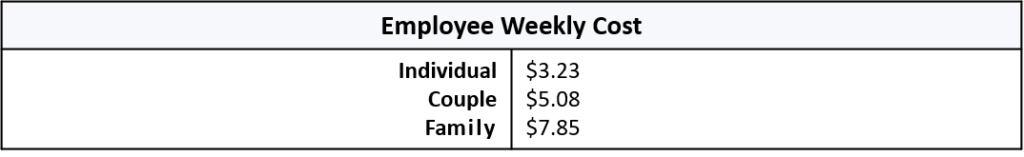

Employee Weekly Cost

| Individual Couple Family |

$11.52 $21.00 $35.08 |

$9.69 $16.85 $26.77 |

$7.15 $12.00 $21.69 |

Contact Information

www.nedelta.com

Phone: 800-832-5700

Email: nedelta@nedelta.com

Forms and Plan Documents

Forms and Plan Documents

Eligibility

PFW offer Voluntary Life Insurance/AD&D to all full time, benefit eligible employees. All employees are eligible to enroll in this benefit the 1st of the month following 90 days of employment. Employees pay 100% of this benefit and rates are based on age bands.

Voluntary Life Insurance

- Employees and Spouses: $10,000 to $500,000 in increments of $10,000.

- Employee guaranteed issue amount: $100,000

- Spouse guaranteed issue amount: $30,000

- Dependent Children: 14 days to 6 months – $1,000 flat benefit amount

- Dependent Children: 6 months to 25 years – Choice of $2,500, $5,000, $7,500, or $10,000 (one benefit amount and one rate for all eligible children in family)

Voluntary AD&D

- Employees and Spouses: $10,000 to $500,000 in increments of $10,000.

- Employee guaranteed issue amount: $100,000

- Spouse guaranteed issue amount: $30,000

- Dependent Children: 14 days to 6 months – $1,000 flat benefit amount

- Dependent Children: 6 months to 25 years – Choice of $2,500, $5,000, $7,500, or $10,000 (one benefit amount and one rate for all eligible children in family)

Eligibility

PFW offer Voluntary Long Term Disability to all full time, benefit eligible employees. All employees are eligible to enroll in this benefit the 1st of the month following 90 days of employment. Employees pay 100% of this benefit and rates are based on age bands.

Long Term Disability

Long Term Disability insurance protects an employee from loss of monthly income in the event that he or she is unable to work due to illness, injury, or accident for a long period of time.

Eligibility

PFW provides short term disability insurance and contributes to the entire cost for all full time, benefit eligible employees. All employees are eligible for this benefit the 1st of the month following 90 days of employment.

Short Term Disability

- Begins on the 1st day of a Disability due to Accidental Injury; and 8th consecutive day of Disability due to an illness.

- Pays 66 2/3% of an employee’s weekly earnings up to $1,750 per week and for a maximum of 26 weeks.

Eligibility

All employees are eligible for Voluntary Accident and Voluntary Critical Illness coverage the first of the month following 90 days of employment. Employees pay 100% for these benefits.

Voluntary Accident Insurance

No one likes to think about the possibility of an accident, but the likelihood — as well as the havoc it can cause for families — is very real. Whether it’s an automobile accident, sports injury or the inevitable slip-and-fall, an accident can bring about not only lifestyle challenges but tangible economic ones as well.

Voluntary Critical Illness

Reliance Standard’s Voluntary Group Critical Illness insurance provides a fixed, lump-sum benefit when critical illness strikes. This includes heart attack, stroke, paralysis and more.

While nothing can replace you, having individual life insurance can protect your loved ones financially. The Richards Group is please to offer a simplified, 100% online solution to get individual life insurance coverage.

- No in-person medical exam necessary

- Just answer a few easy questions about your current health

- View options that fit your needs and budget

- Our AI-powered recommendation engine pulls options from trusted insurance agencies tailored to you and your family’s unique situation needs.

- Select and purchase a plan

- Get qualified instantly, or schedule an online consultation to determine the best fit. No need to wait for open enrollment – your plan is active in just 1-3 weeks from initial selection.

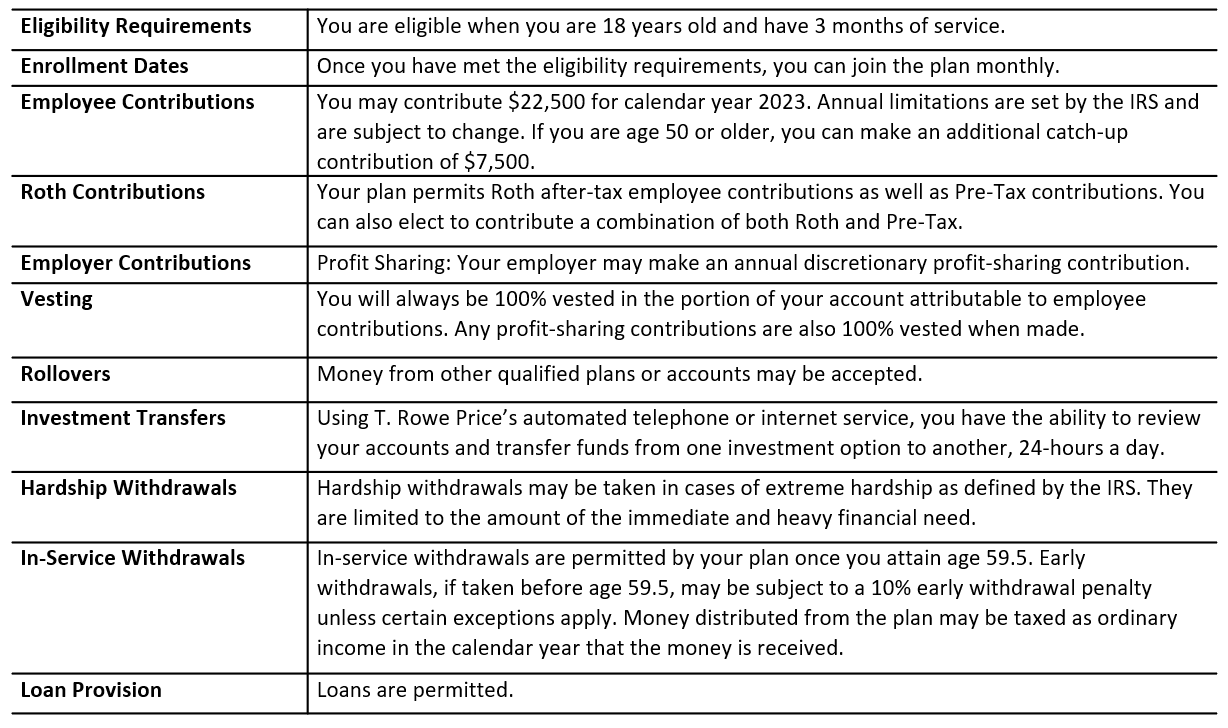

Pet Food Warehouse offers a 401(k) plan to employees through T. Rowe Price. T. Rowe Price offers a wide selection of investment options and excellent online technology to help you better plan for retirement. Basic plan details are listed below and outlined in more detail in the Summary Plan Description. If you have questions about the plan, you can send an email to HelpRetire@therichardsgrp.com to receive assistance from TRG Retirement Plan Consultants. You can also call T. Rowe Price directly at (800) 354-2351 or access your account online at www.rps.troweprice.com/.

Contact Information

Investment Advisor

TRG Retirement Plan Consultants

(802) 254-6016

Important Documents

Student Loan Assistance

Pet Food Warehouse student loan assistance program is designed to help Pet Food Warehouse employees pay back student loan debt and improve their financial well-being.

Utilizing Pet Food Warehouse’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will:

- Provide one-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- Offer a competitive interest rate reduction when you refinance your loans.

- Offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Us

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Forms and Plan Documents

VERIZON WIRELESS EMPLOYEE DISCOUNT

Any active employee (full or part time) with their own Verizon Wireless account can receive a discount from Verizon on their monthly statement. The employee needs to bring a copy of their pay stub (as evidence of employment) to any Verizon store where they will go through an Employee Verification Process. Once the process is completed the employee will be advised of the discount they will receive, based on their current Verizon plan.

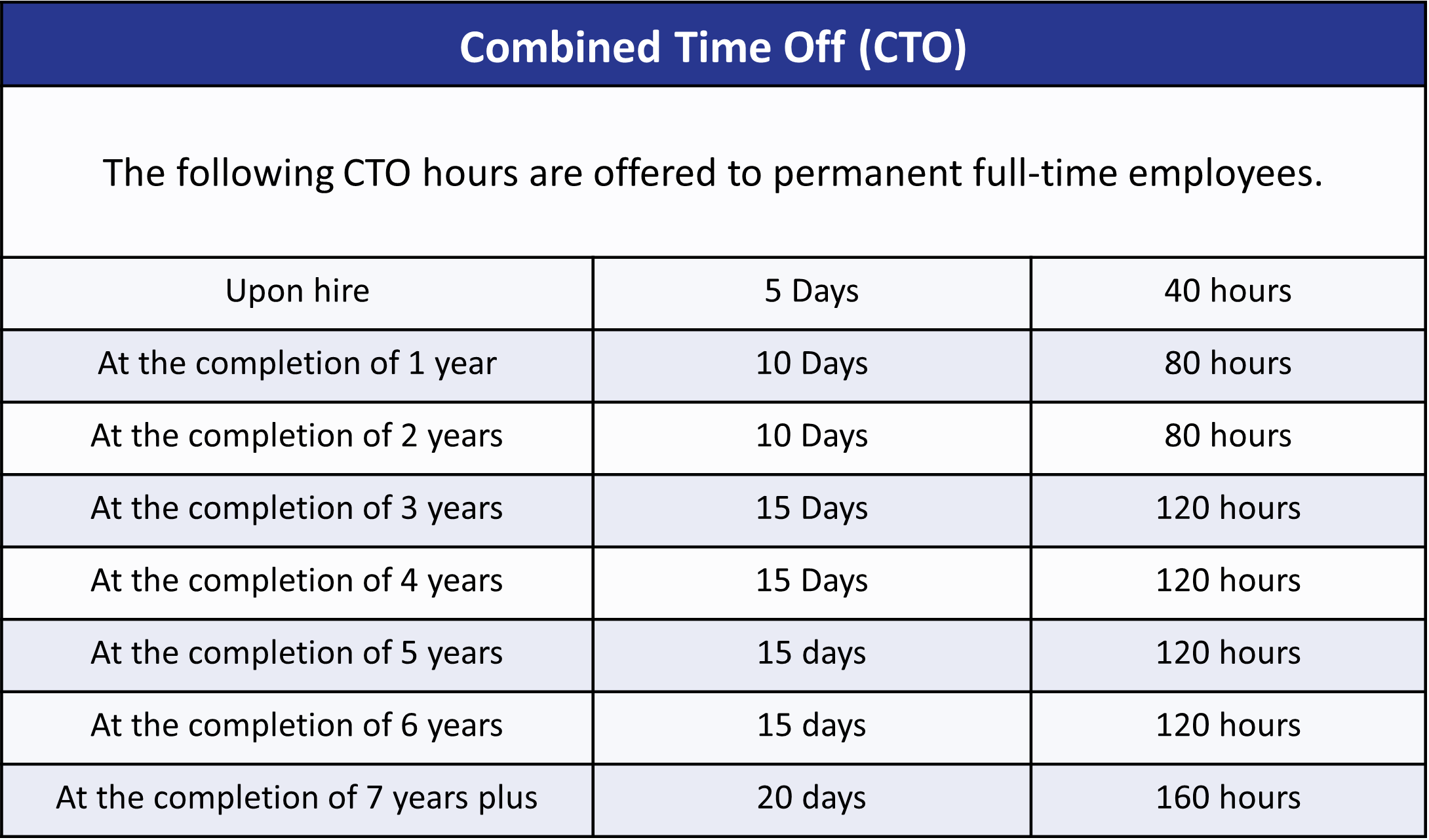

Upon hire all employees are eligible to participate in the following programs:

VOLUNTEER FOR CTO TIME:

If a full-time employee chooses to do so, PFW will give each eligible employee up to an additional 8 hours of CTO time per calendar year for exchange of time volunteering for an organization that supports, promotes or in some way helps animals. Prior approval must be obtained by the General Manager. There is no waiting period to take advantage of this benefit.

EMPLOYEE FEEDING PROGRAM:

As a distributor for many of our food lines, some of the manufacturers allow us a significant discount off our cost of their food for employee feeding and PFW pays the balance – which allows the employee to feed their dog or cat for free.

EMPLOYEE PURCHASE PROGRAM:

Employees will be entered in the POS as a customer, which gives the employee discounts on products purchased in our stores.

PET WASH PROGRAM:

Employees may use the Pet Wash Monday through Friday at no cost for their pet(s) only, based on availability.

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information